The House Always Wins

What trying to buy a home taught me about the system behind money and markets

“The game is out there, and it's either play or get played.”

Omar Little, The Wire

Throughout 2022, my girlfriend (now wife!) and I felt priced out of the housing market. Mortgage rates were rising. So were home prices. And every showing seemed filled with cash buyers ready to waive inspections and close in a weekend.

So we pivoted.

Beginning that fall, we spent the next 18 months living with my parents and her parents, with some well-timed Airbnb excursions across the country to break up the routine. We’re lucky: not just to have had this option, but to have parents who made it feel easy, not intrusive.

The plan was simple: cut rent, build our down payment, and wait for the market to normalize.

We eventually got engaged and moved into an apartment while planning our wedding. Now that we’re married, the focus shifts back to home ownership, and it suddenly feels like our 2022-24 savings aren’t stretching as far as they should be.

That dissonance, between the effort of saving and the reality of what it buys, sparked a new obsession. I started researching housing economics, inflation, and real interest rates with the same intensity I usually reserve for fantasy sports.

Here’s what I found.

The Metric That Matters

Homeownership used to mean asking, “Can we afford this house?” Now it means asking, “Can we afford this monthly payment?”

That’s what payment-to-income (PTI) measures. It’s the most intuitive way to understand how the housing market has shifted in the post-pandemic era. The formula works like this:

PTI = Monthly Mortgage Payment (Principal + Interest) ÷ Monthly Household Income

Principal = the amount borrowed after your down payment

Interest = the cost of borrowing, based on your mortgage rate

Most affordability headlines focus on median home values. But prices alone don’t capture what buyers actually feel, which is the monthly payment. PTI does.

Since 2020, three things have happened:

Asset prices rose (including home values)

Mortgage rates surged

Incomes grew, but not enough to keep pace with rising monthly payments

PTI showed me why the math on housing got worse. Our own mistake was letting the math on our savings stand still.

The Savings Mistake

For my wife and me, the pain was worse because our savings weren’t working for us.

Instead of using a high-yield account or even short-term Treasuries, we left our money in a traditional savings account earning 0%. Meanwhile, the S&P 500 surged. Even if we didn’t want equity risk while saving for a down payment, we could’ve earned real yield — actual return after inflation — from the very same rates that were keeping mortgages elevated.

We’re invested differently now, but it’s frustrating to think about the missed income. Call it being naive savers. That mistake taught us that it’s not enough not to spend. You also have to understand the broader game board.

The Real Rate Lesson

What we didn’t realize at the time was that the gap between what we earned from saving and what inflation was erasing has a name. It’s called the real interest rate.

Think of it as the true return on your money after adjusting for rising prices. Your balance might increase, but if inflation is rising faster, your purchasing power slips backward.

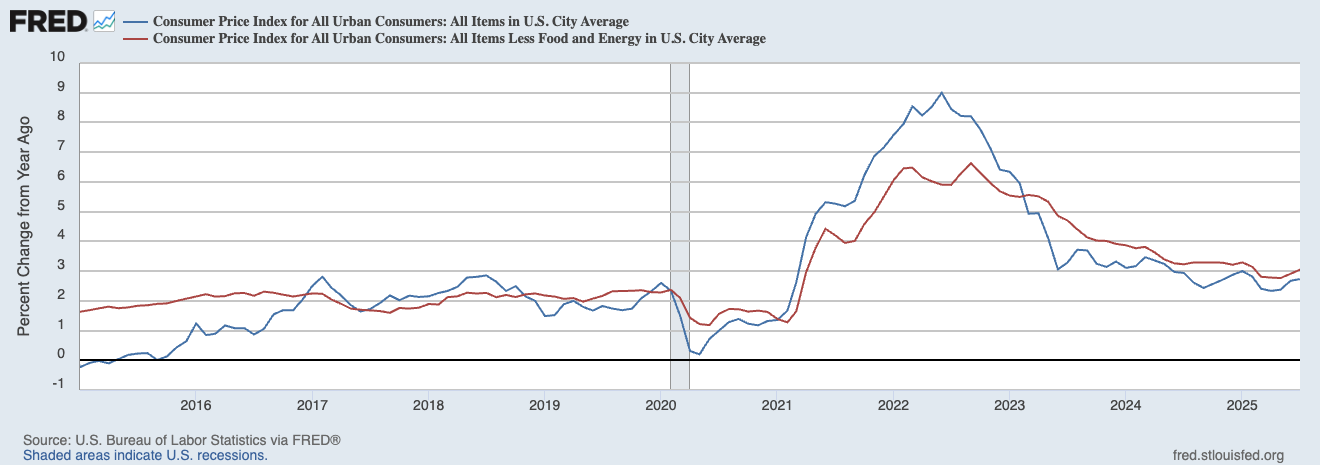

As shown below, inflation — measured by the Consumer Price Index (CPI) — spiked in 2021-22. It eventually cooled, but the damage had already been done.

For us, that meant nearly two years of “free rent” savings in a Bank of America account earning 0%, while inflation quietly shrank the value of those dollars.

This is why our savings don’t stretch as far as they should. Even when you’re disciplined, the real game is about what your money can buy, not the raw dollar amount.

The Freeze

But housing didn’t ease up once inflation cooled. It froze. As of late summer 2025, the market has come to a standstill.

Here’s the paradox:

Buyers can’t stomach today’s payments (high PTI).

Sellers don’t want to give up their locked-in 3% rates.

With no forced selling, prices don’t fall.

For anyone who currently has a low mortgage rate, moving right now isn’t just a question of where to live. It’s a financial equation of whether or not it makes sense to surrender such a favorable monthly payment.

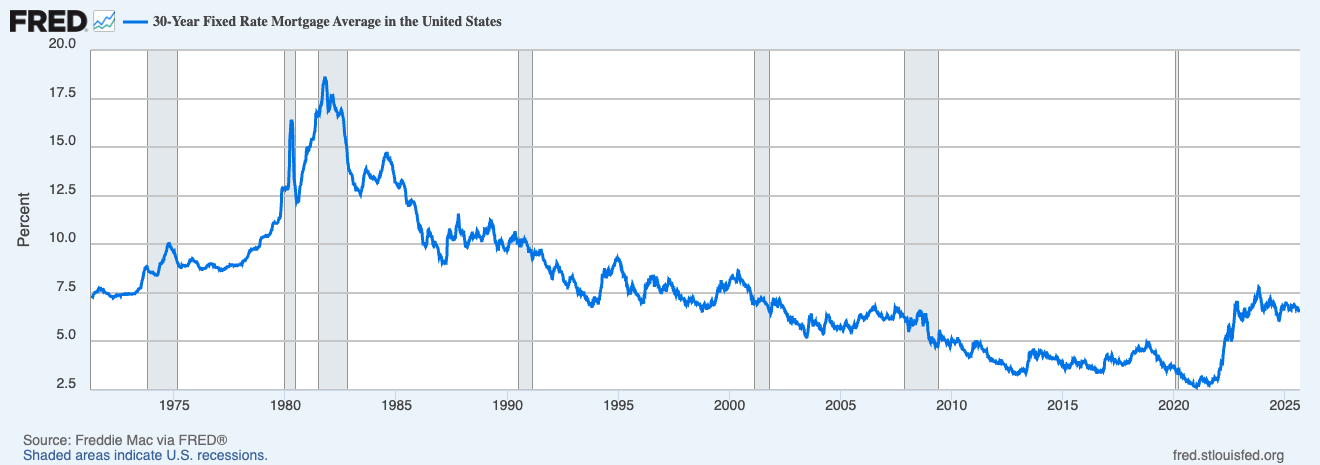

Refinancing made sense to earlier generations because rates tended to trend down. For decades, homeowners bought at one rate and refinanced at a lower one. That experience created an assumption that rates always fall. However, after 2020, the opposite occurred, and we’re still waiting to see if they return to their previous levels.

That’s what made the 2021-22 scramble to lock in rates so intense. People saw what was coming. They felt inventory shrinking.

So, what would it take to tilt the game back in favor of buyers? In theory, PTI can fall in three ways:

Lower Prices — If home values drop sharply, monthly payments would also fall. But that scenario would involve financial pain for existing homeowners and likely ripple through the broader economy. It isn’t the healthiest outcome.

Lower Rates — This feels like the most realistic and sustainable lever. Mortgage rates won’t fall as severely as they did during the pandemic, but even returning to the 4.5–5% range we saw in 2018 would go a long way toward making payments more manageable.

Higher Incomes — This one depends more on individuals than the system. For families, earning more is often the quickest way to beat the housing squeeze. Of course, that’s easier said than done.

Most likely, it’ll take a mix of all three. Slightly lower prices, somewhat lower rates, and gradual income growth together could bring PTI back toward sanity. Until then, the real play is strategy. Adjust where you save, how you earn, and when you buy, instead of waiting for a single magic fix.

Awareness Is the Advantage

When we first started saving, I thought of money in simple terms: cut expenses, stash cash, wait for the right time. I hadn’t considered how inflation could erode our savings or how a sudden rate spike could alter our affordability.

During this time, most conversations about money made me uncomfortable because I hadn’t experienced the forces at play. Since then, I’ve spent more time than my wife would like me to admit being consumed by macroeconomics. What started as frustration over housing has evolved into something more significant.

I don’t claim to have it all figured out. What I do have is awareness. I now understand PTI, inflation, and real interest rates — not as abstract concepts, but as the rules shaping my financial life. And once you know the rules, you stop feeling behind. You start acting with intention.

That’s the real lesson. This wasn’t just about buying a house. It was about learning the rules of the game.

The house always wins. That much is true. But awareness is its own kind of edge — because once you understand the game, you’re not just reacting.

You’re playing.

Brendan,

Very interesting and well written! Nice work.